While 2024 saw Ternium continue to build its position as the leading steelmaker in Latin America, these achievements unfolded against the backdrop of mounting uncertainty in global markets, presenting new challenges and opportunities for continued growth. At our Pesquería complex in Mexico, we completed a new pickling line at the end of the year. In Brazil, Usiminas successfully resumed production at its Ipatinga blast furnace following its relining and modernization during 2023, and, in Argentina, we began operations at our new wind farm in December, which will supply 90% of the purchased energy requirements for our operations in the country.

Net sales amounted to $17.6 billion, in line with 2023, as we consolidated the results of Usiminas for the full year. Although shipments rose, steel prices fell through the year in our most relevant markets. EBITDA declined to $2.0 billion with a margin of 12%. Net income was $174 million, affected by a provision following an adverse court ruling in Brazil, which we continue to dispute. Our balance sheet remains solid with a net cash position of $1.6 billion at year-end. At our shareholders’ meeting, an annual dividend of $2.70 per ADS was approved, reflecting our commitment to maintain a competitive dividend payout over the years. This dividend considers a lower net income level in 2024, net of the provision for litigation in Brazil, and our extensive investment program over the next two years.

Our investment program is centered on our Pesquería complex in Mexico, where we are integrating advanced electric steelmaking and natural gas-based direct reduction facilities while expanding our downstream processing capacity for high-value flat steel products. Once these investments are complete, the Pesquería complex will be one of the most advanced steelmaking and processing sites in North America, compliant with USMCA “melted and poured” requirements and able to supply the ultra-high-strength steel products required by the automotive industry and other demanding industrial and construction applications.

Tariffs and trade tensions in recent months have created a climate of uncertainty, impacting business confidence and economic growth in North America and more widely. To the extent that the tariffs are intended to address unsustainable trade imbalances and China’s unfair trading practices, we are confident that Mexico will be recognized by the United States as a valuable ally and partner in strengthening manufacturing activity and addressing trade imbalances across North America and that the USMCA will be renewed with a favorable tariff treatment for its members and stricter rules of origin to prevent unfairly traded imports in the region.

In Mexico, amidst the current uncertainty concerning tariffs and the economy, the government is pursuing a “Plan Mexico” strategy to attract investment and increase the local and regional content of manufactured goods through nearshoring, infrastructure development and support for SMEs. Ternium is well placed to contribute to this strategy: it continues to consolidate its leading position in the domestic market as a supplier of advanced steel products for local industry and infrastructure projects, it is investing in developing capacity and products to replace imports, and it has its own ProPymes program which is designed to support the development of SMEs. Once the uncertainty concerning tariffs is lifted, we expect to see the Mexican industrial economy emerge stronger as part of a revitalized USMCA trading block.

In Brazil, the industrial markets that Usiminas serves have been growing strongly and, following the modernization of its Ipatinga blast furnace, it has increased sales and production while reducing costs. We continue to see, however, the pressure from unfairly traded steel imports as China increases its exports of surplus steel production to Latin America, where Brazil is its largest regional trading partner. Although the government has taken some measures to limit such imports, their effectiveness is still to be seen.

In Argentina, the economy has started to recover following the government’s measures to reduce inflation and liberalize the economy. The transformation that is being undertaken is having profound effects on the economy and is expected to lay the foundations for growth for the years ahead following 15 years of stagnation. Last year, our sales in the Southern Region declined 33% compared to 2023 as volumes were affected by a contraction in the industrial and construction sectors. As 2025 progresses, we are seeing a recovery in demand in some sectors, such as energy, agriculture and mining, although some other sectors like construction continue to show subdued activity levels.

For Ternium, like other companies operating in the steel industry, decarbonization is a major challenge that will take many years and substantial investments to accomplish. The integration of state-of-the-art electric furnace steelmaking and direct reduction facilities into our operations in Pesquería, Mexico, represents a significant part of our plans to reduce the emissions intensity of our operations in line with our 2030 decarbonization target and prepare for further reductions thereafter. Our investment in a 99 MW wind farm, completed during 2024, to replace 90% of our purchased electric energy requirements in Argentina is an additional step towards that target. Usiminas has also established a 2030 target to reduce its emissions intensity by 15% compared to a 2019 baseline to which the recent modernization of the Ipatinga blast furnace will contribute. At the same time, we need to identify and develop economic, scalable technologies that will enable further decarbonization of our operations beyond 2030. In this respect, we are participating in a pilot plant to produce turquoise hydrogen through methane pyrolysis and are partnering with Vale to develop raw material products with lower carbon emissions intensity.

As an industrial company with a long-term perspective, the safety of our people, protection of the environment and support for the inclusive development of our communities are an integral part of our management agenda. In addition to our decarbonization program, we are advancing with a multi-year $550 million investment plan to enhance our environmental performance through improving the management of water and air emissions and maximizing the recycling and reuse of resources at our industrial facilities. This reflects our commitment to setting an example on managing environmental issues within our communities. Among the projects already implemented under this plan are the installation of a dome and iron ore silos to control dust emissions at our Guerrero plant in Mexico, the incorporation of technology for the measuring and control of air emissions in our plants in Argentina and Brazil and improvements in the settling ponds and water treatment systems throughout our industrial system.

In 2024, we invested a further $60 million in projects aimed at improving our safety performance. Many of our safety investments over the past four years have been in automation to reduce human participation in high-risk operations, such as continuous casting. This has resulted in a significant reduction in human exposure to hazardous conditions. This year, we received a Health & Safety Excellence Recognition from worldsteel for this safety program. Our performance during 2024, however, was affected by two fatalities. This is a major setback for Ternium, which has an absolute commitment to safety with its employees and its communities. We deeply regret the loss of life and are reinforcing all our actions on preventive activities with a focus on critical risks.

As we engage with our communities, our educational programs are at the forefront of our efforts to support inclusive growth. They are designed to open opportunities, encouraging merit and an entrepreneurial spirit. We accompany the development of students from a young age with our Roberto Rocca After School Program and are strengthening our network of Roberto Rocca Technical Schools. Early this year, we opened a new school in Santa Cruz, Brazil, which will receive 576 students over the next three years and will share curriculum and best practices with its sister schools in Pesquería, Mexico, and Campana, Argentina. These schools open their doors not only to their enrolled students but also act as professional training centers for their communities offering various Industry 4.0 training courses and certifications licensed by companies such as Festo and Siemens. The educational institutions are obtaining excellent results and the new school in Santa Cruz has created high expectations in the community surrounding our Brazilian slab mill.

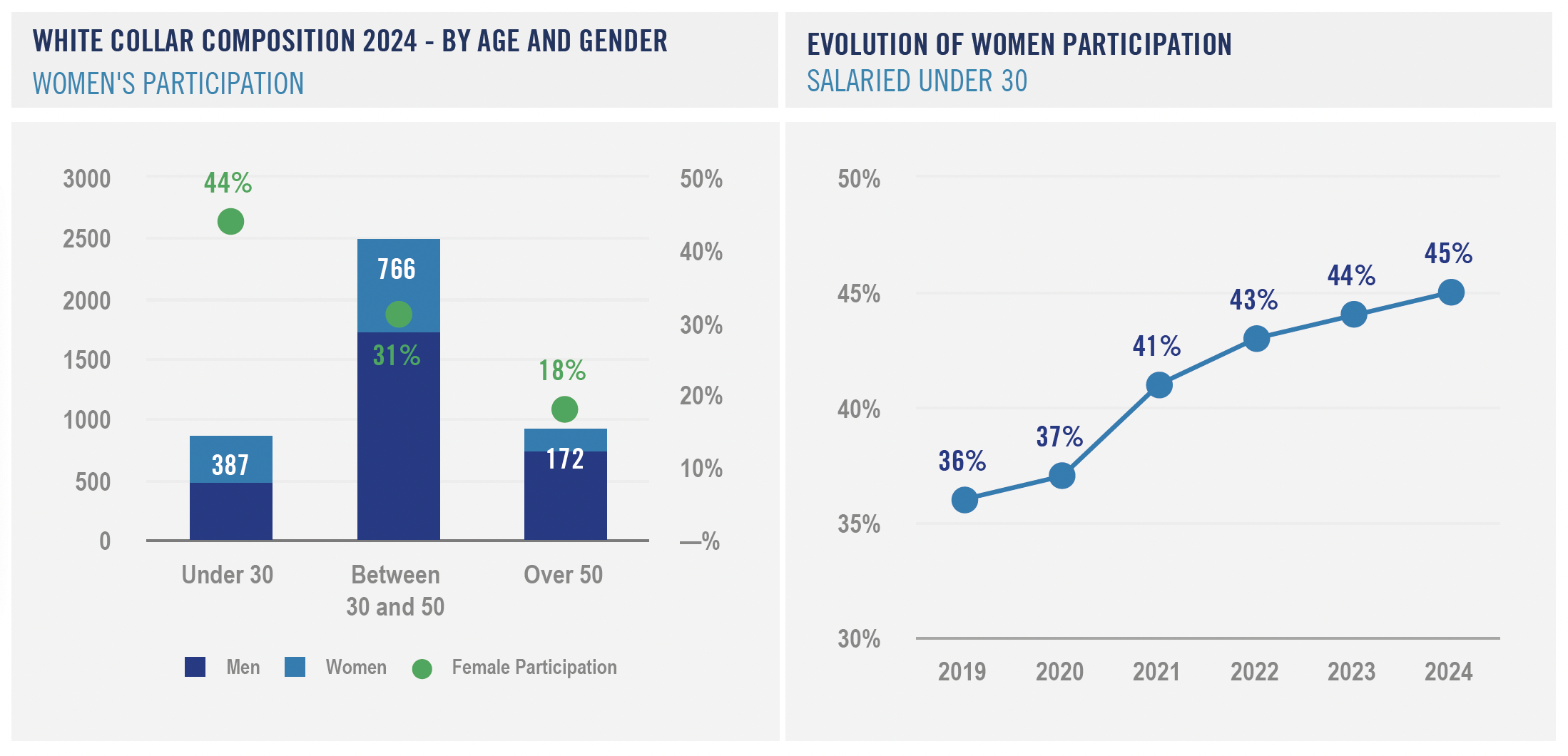

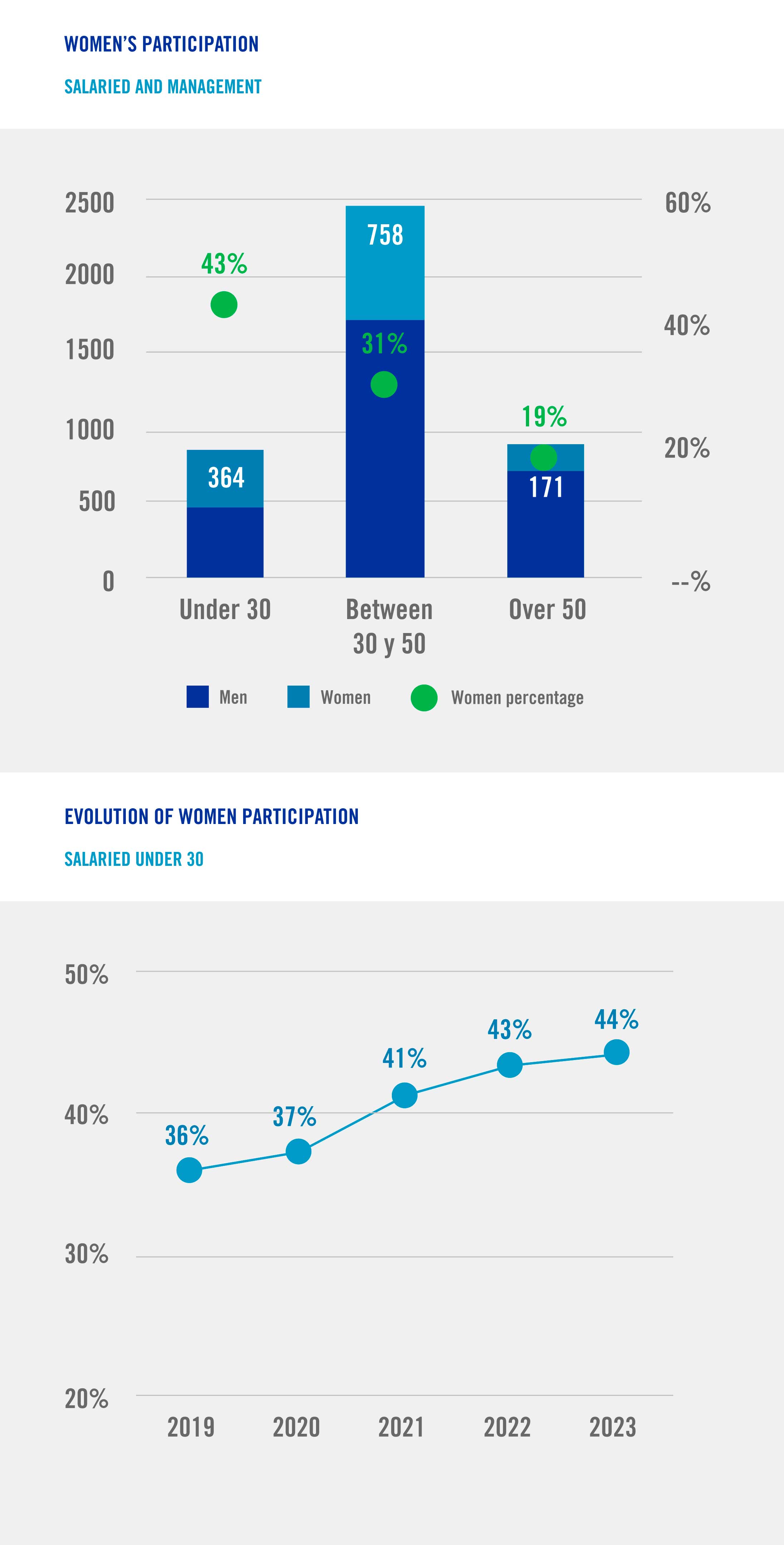

Our employees are always at the center of our achievements. Our aim is to offer them the opportunities to develop their skills and potential in a respectful and dynamic working environment in which they are recognized for their contribution to our goals. We are also focused on enhancing diversity and improving the gender balance among our employees and in managerial positions, recognizing the positive benefits to our industrial culture that diversity can bring.

In closing, I would like to give a special thanks to them for their ongoing efforts and achievements over the past year. I would also like to thank our customers, suppliers, shareholders and communities for their continuing support for our project.

July 2025